Leveraging Pips in Your Forex Trading Strategy

Understanding and utilising pips is crucial for building an effective forex trading strategy.

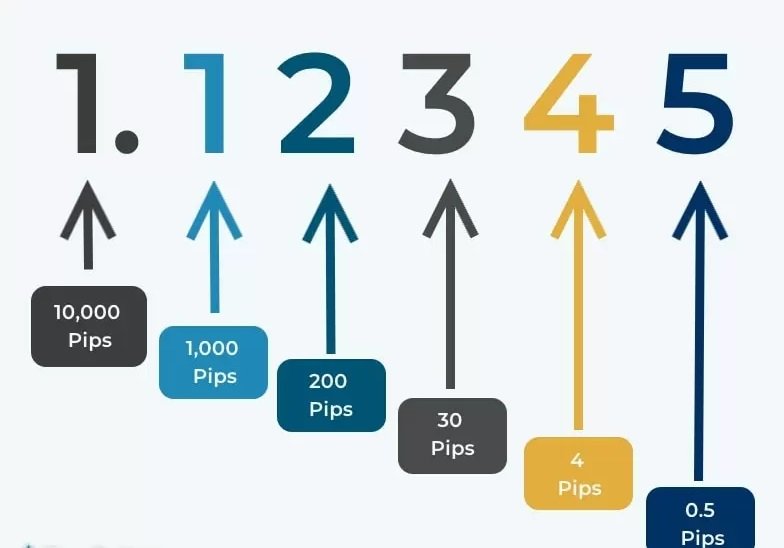

According to the market convention, pips denote the smallest price change in a

currency pair's exchange rate. Mastering this can significantly boost performance. By

incorporating precise pip measurements into trading decisions, traders gain a deeper

comprehension of market movements, which can lead to enhanced efficacy. This article

explores various methods to incorporate pips into forex trading strategies, offering

traders valuable insights and practical guidance.

Spot Trading

Once you know what is a pip in forex, it's crucial to understand its role in spot trading.

This approach entails buying and selling currency pairs according to the prevailing

market prices. Pips measure the price fluctuations of these pairs, providing traders with

real-time data on value changes.

By closely monitoring pip movements, traders can determine the right times to enter or

exit trades, optimising their chances for profit or minimising potential losses. Consistent

tracking of its movements offers a clear view of market volatility, which is essential for

making informed trading decisions. Additionally, understanding how pips correlate with

market trends enables traders to forecast future price movements more accurately.

Futures and Forwards Trading

Even in futures and forwards trading, pips play a significant role. Although these

contracts have fixed exchange rates, real-time spot price movements are still tracked

using pips. These movements offer insights into the profitability of a trade. Significant

favourable changes in the spot price can indicate potential success for futures or

forward contracts. Thus, monitoring its movements allows traders to make well-informed

decisions about their positions and necessary adjustments.

This understanding helps traders hedge against risks by adjusting their strategies

accordingly, ensuring they can take advantage of favourable conditions while mitigating

losses in less favourable scenarios.

Leverage Trading

In this, the importance of pip movements is amplified. This method allows traders to

control a prominent position with a relatively small capital. Leverage magnifies the

impact of its changes, meaning even minor fluctuations can result in significant financial

outcomes. Therefore, precise tracking and prediction of pip movements are crucial for

managing risk and optimising returns in leverage trading.

Effective leverage can increase potential returns but necessitates a robust risk

management strategy to avoid substantial losses. Understanding the relationship

between leverage and its movements helps traders better plan their entry and exit

points.

Protecting Your Positions

Pips protect trading positions by stopping losses and taking profit orders. These tools

automatically close trades when the market moves beyond specified pip thresholds,

which the trader sets. By establishing these parameters, traders can shield their

investments from adverse market movements. Using pips to set these limits ensures

precision and supports a disciplined risk management approach. This strategy aids in

maintaining control over outcomes and preserving capital.

Regularly reviewing and adjusting these thresholds based on market conditions can

enhance the effectiveness of these protective measures. Understanding pip movements

and market dynamics is critical to setting realistic and effective stop loss and take profit

levels.

Market Analysis

Analysing market movements through pips provides critical insights into forex market

trends and dynamics. Traders can extend their analysis across various

timeframes—daily, weekly, monthly, or annually—to identify broader market patterns.

By examining pip movements over these periods, traders can detect trends, volatility,

and potential reversal points. This detailed analysis aids in strategic planning and helps

traders position themselves in the market.

Recognising these patterns through pip analysis is crucial for long-term investment

success. Integrating pip analysis with additional technical indicators provides a broader

perspective on market conditions, allowing traders to craft more advanced and effective

strategies.

Monitoring Economic Indicators

Economic indicators and their effects on currency pairs can be measured using pips.

Significant economic announcements, such as changes in interest rates or employment

data, often lead to substantial pip fluctuations. By carefully tracking these indicators and

understanding their potential effects on the market, traders can better predict and react

to price movements. Quantifying these movements in pips precisely explains how

economic events affect the forex market.

Furthermore, being informed about upcoming economic events and their anticipated

impact on pip movements allows traders to prepare and adjust their strategies. This

proactive approach aids in risk management and seizing opportunities that economic

news presents.

After knowing what is a pip in forex, mastering the use of pips in forex trading strategies

makes it easy to handle the complexities of the forex market. Integrating pips into these

strategies enhances precision, improves risk management, and boosts outcomes.

Understanding and utilising pips supports immediate trading decisions, long-term

strategic planning, and success in forex trading. With continuous learning and

adaptation, traders can leverage pips to achieve sustained profitability and resilience in

the ever-evolving forex market.

Post Comment